FCC Alliance Business Support

Don’t Let Tax Time Get You Down! We have resources to help!

On March 22, 2023 the Camden & Monmouth Family Child Care Alliance held a tax preparation webinar going over basic concepts, business expenses, shared expenses, IRS forms, and worksheets and templates to help FCC providers. If you missed the session, you can watch the recorded video here. The slide presentation is also available in English and Spanish.

Tom Copeland 2021 Tax Return Recorded Webinar and Slides

Blogs:

• Tom Copeland: Should You Apply for Your State’s Stabilization Grant? Yes!

• Tom Copeland: Questions and Answers About the Child Care Stabilization Grant

Try the NJAEYC online Family Child Care Toolkit. Forgot your password? No worries. Ask your local Child Care Resource & Referral (CCR&R) agency for help. There are literally hundreds of resources to help support registered family child care providers in operating their business. CCR&R staff can help walk you through what is available and how the resources connect to your daily work.

Tax Tips: (Resources to help take the stress out of tax information organizing and preparation).

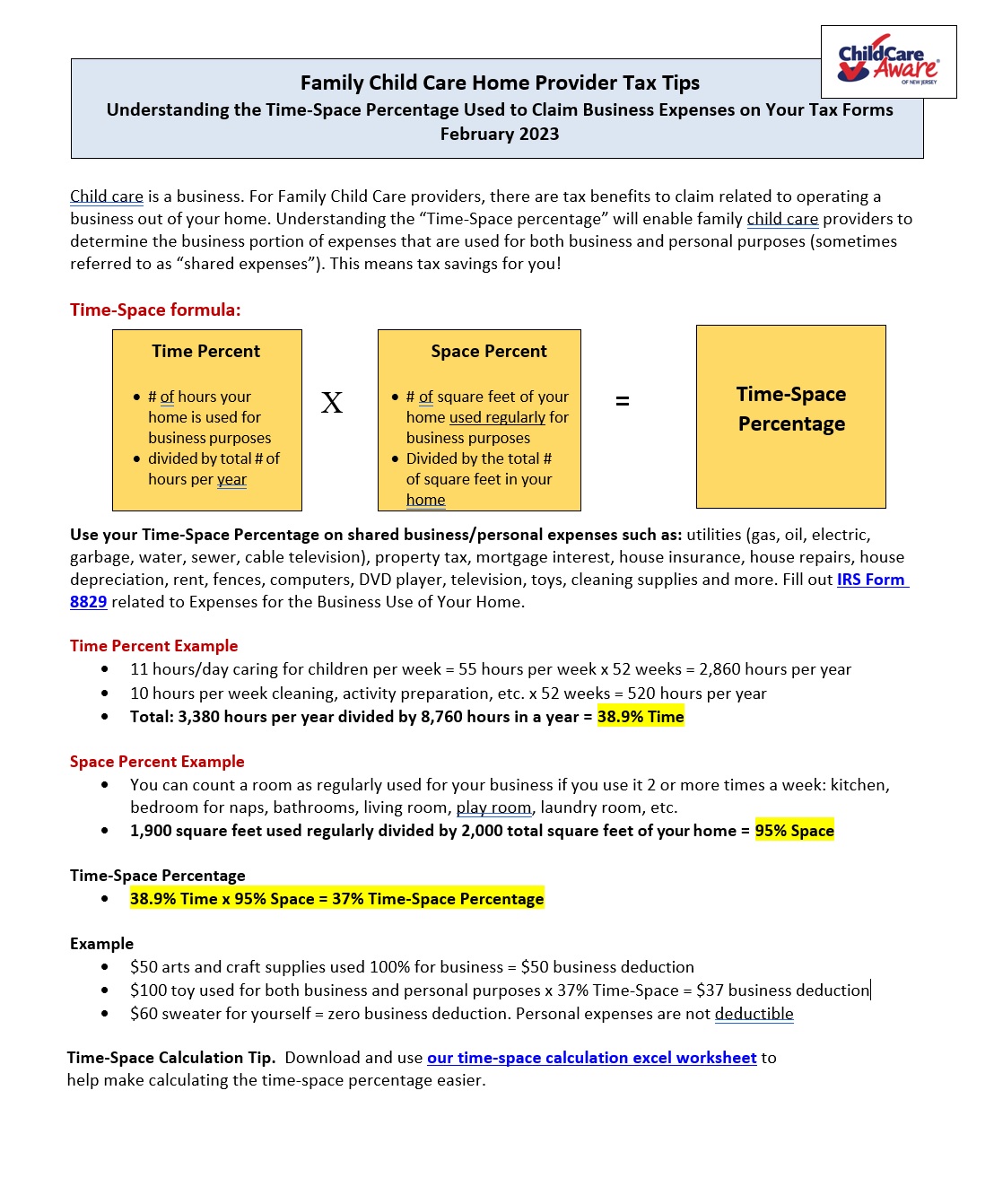

The Time-Space Percentage Explainer. The time-space percentage is important because this is the percentage that is applied to shared expenses (i.e., expenses that are partially business related and partially personal) when adding deductible expenses to your tax forms.

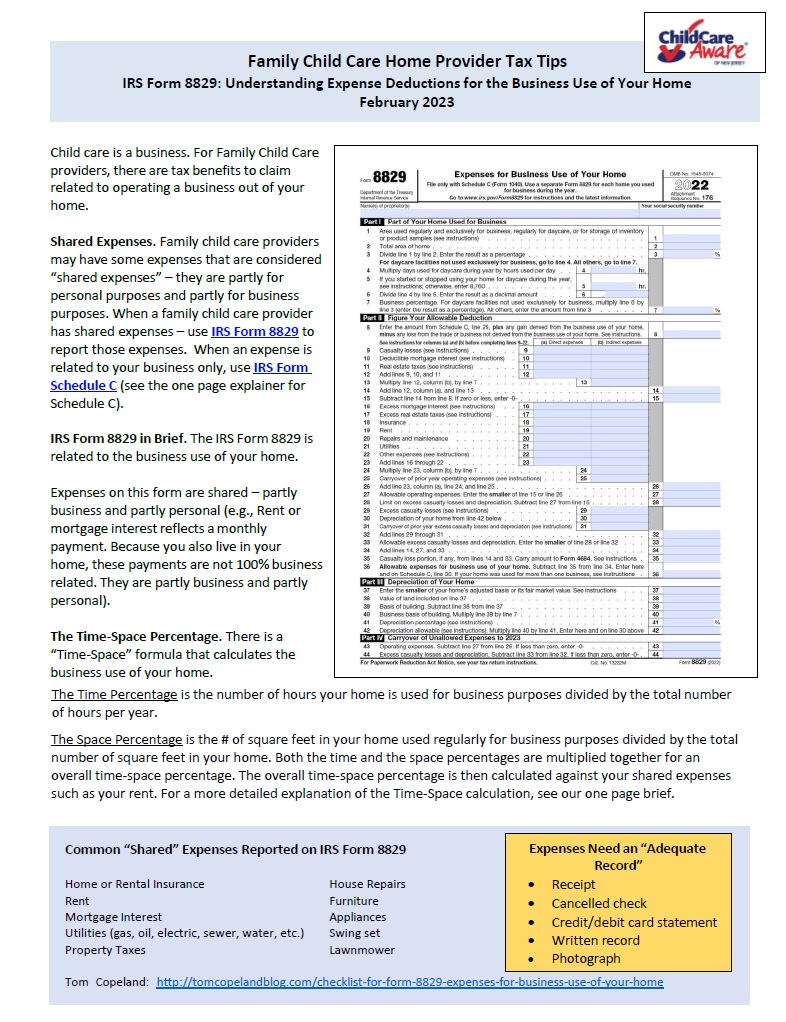

IRS Form 8829 Explainer. This is the IRS form where you list shared expenses. The time-space percentage is used for the calculation on this form.

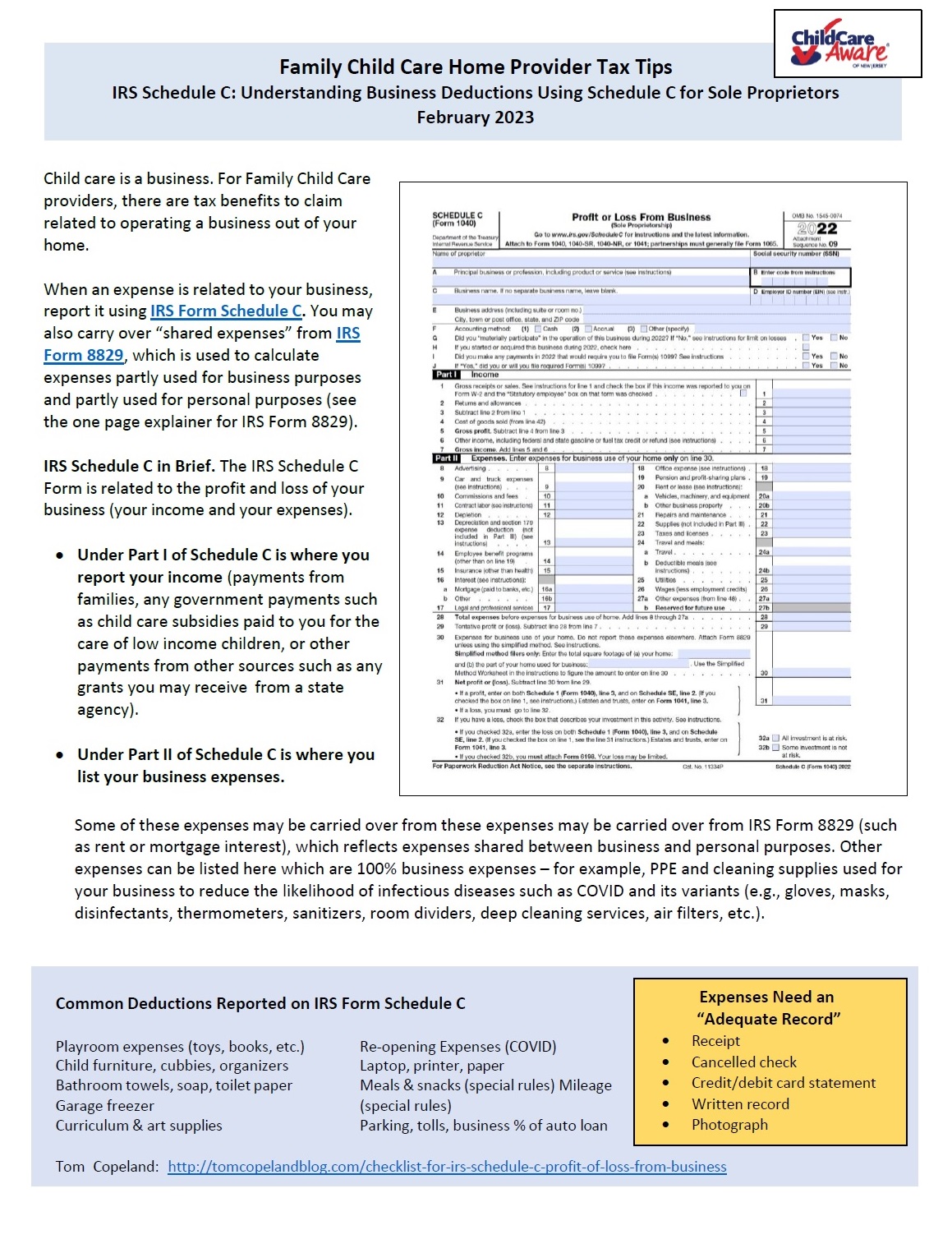

IRS Schedule C Explainer. This is the IRS form where you list all your expenses that are 100% related to operating your business.

Want to learn more? Check out the online family child care toolkit, tax tips section, for additional information, worksheets, and helpful tips!

Health Insurance Resources

The American Rescue Plan made health care coverage more affordable! The Inflation Reduction Act extended health care subsidies through 2025.

- American Rescue Plan Health Insurance One Pager (August 29, 2022)

- Recorded Webinar with Q&A. 2020 Tax Returns: Tips for Family Child Care Home Providers (Handling Grants, COVID business expenses, & More!), January 2021

- Slide Presentation from the 2020 Tax Return Recorded Webinar

Additional Resources You Can Use!

These one pagers are easy-to-understand explanations of IRS forms and business calculations to save you money!

- Understanding the Time-Space Percentage Used to Claim Business Expenses on Your Tax Forms (A one page explainer, English and Spanish)

- IRS Form 8829: Understanding Expense Deductions for the Business Use of Your Home (A one page explainer, English and Spanish)

- IRS Schedule C: Understanding Business Deductions Using Schedule C for Sole Proprietors (Profit or Loss Business IRS form, a one page explainer, English and Spanish)

Other Resources from Tom Copeland

- Tom Copeland’s web site

- 2020 Tax Changes Affecting Family Child Care Providers (February 17, 2021)

- What Are the Tax Consequences of a State Grant? (February 8, 2021)

- How to Find, Choose and Work with a Tax Professional (January 16, 2021)

- Recorded Webinar with Q&A. The Tax Consequences of Coping with COVID-19: Tax Tips for Family Child Care Home Providers (Deductible expenses, calculating the time-space percentage, understanding SBA programs, deciding when to claim Social Security, and more!), February 17, 2021

- Slide Presentation from the Tax Consequences February 17, 2021 Recorded Webinar

Links to Internal Revenue Service Forms & Material

- IRS Form Schedule C – Profit or Loss from Business (Sole Proprietorship)

- IRS Video – Schedule C: Who need to file this form and how to do it

- IRS Publication, Schedule C Instructions & Additional Information

- IRS Form 8829 – Expenses for Business Use of Your Home

- IRS Publication, Form 8829 Instructions & Additional Information

- All IRS Forms and Publications

U.S. Small Business Administration (SBA) Business Relief Options for Family Child Care Homes

In response to the COVID-19 public health pandemic, Congress passed several bills in 2020 to provide business relief, particularly for small business owners such as family child care home providers.

2023 Update

The SBA Paycheck Protection Program (PPP) Online Forgiveness Portal

In August 2021, the SBA opened a new online PPP loan forgiveness portal for loans of $150,000 or less. This means that businesses that received a PPP loan can apply online through the SBA instead of going through their lender that approved the loan.

The SBA created the new online forgiveness portal to help expedite forgiveness approval, which turns the loan into a grant (i.e., borrowers will not have to repay it). The new online portal is designed to speed up the approval of forgiveness for small loans ($150,000 or less).

SBA Form 3508S. This form is for borrowers of $150,000 or less. It’s a short one page form. No calculations are required. Borrowers do not need to submit documentation. However, the SBA requires retaining all records for Form 3508S for four years (in case borrowers are subject to a random audit).

The SBA Paycheck Protection Program (PPP) expired on May 31, 2021. As long as borrowers use the funds for eligible expenses, borrowers can apply for “forgiveness”, which is what turns the loan into a grant that does not need to be repaid. Borrowers need to apply for forgiveness within 10 months of spending the money.

How and when to apply for loan forgiveness

Borrowers can apply for forgiveness once all loan proceeds for which the borrower is requesting forgiveness have been used. Borrowers must apply for forgiveness within 10 months after the last day of the covered period (the 8-24 weeks for which the loan covered). If the borrower does not file for forgiveness within 10 months, then borrowers will need to begin making loan payments to their PPP lender to repay the loan.

Applying for Forgiveness. Since August 2021, the SBA has operated an online PPP loan forgiveness portal for applicants who borrowed $150,000 or less. For businesses that may have missed the deadline, payments began at a 1% interest rate. Businesses can still file for forgiveness once they’ve started repaying the loan, as long as the loan has not reached its date of maturity.

To apply for forgiveness, contact your lender.

Once you have spent the PPP funds, contact your PPP lender and complete the correct form.

SBA Online Forgiveness Portal Tips! When you first visit the online portal, you will be required to set up an account (with your email) and create a password. Write down the password to save it! You will receive an email to verify that you want to create an account. It’s quick, just click on the link and confirm. Once your account is set up (which is really fast), you will need to have this information ready to submit through the portal:

- EIN, SSN, or ITIN

- SBA Loan #

- Gross Receipts 2019

- Gross Receipts 2020

- # of employees at time of application (remember: family child care providers need to claim themselves as an employee, so your answer would be “1” unless you have an employee, and then your answer is “2”, which includes yourself)

- # at time of forgiveness (same as above)

- Amount of PPP spent on payroll

SBA Portal User Guide! The portal is really simple. However, reading through the user guide can make the portal submission process much faster and may help answer any questions you have. If you do have questions, the SBA has set up a hotline where a team of SBA staff are ready to answer any question! If you have two PPP loans (a first draw loan and a second draw loan, you must apply for forgiveness for each loan separately).

SBA Hotline: 877-552-2692

Brief Background About PPP loans. Congress created the PPP “forgivable loan” (in other words, a grant) for small businesses in March of 2020. Congress has extended PPP several times. In December 2020, Congress separated PPP into two programs.

- First Draw PPP forgivable loans are for businesses that did not receive a PPP forgivable loan in 2020.

- Second Draw PPP forgivable loans are for businesses that received a PPP forgivable loan, but still have additional need for financial support. The Second Draw PPP loans are restricted to businesses with 300 or fewer employees and must be able to show at least a 25% reduction in revenue between comparable quarters in 2019 and 2020.

As long as borrowers use the funds for eligible expenses, borrowers can apply for “forgiveness”, which is what turns the loan into a grant that does not need to be repaid. Borrowers need to apply for forgiveness within 10 months of spending the money.

Overview of Eligible Expenses for Forgiveness

In general, in order for forgiveness to be approved, at least 60% of the funds must be used for payroll related costs. This means up to 40% of the loan can be used for fixed costs such as mortgage interest, rent, utilities, software used for your business (e.g., for record-keeping or supporting other business operations), perishable goods (such as food costs), expenses for PPE, cleaning supplies, and other expenses related to social distancing and public health requirements related to COVID. For family child care providers, you are eligible for a PPP forgivable loan whether or not you have employees. (For example, for purposes of the PPP loan, an FCC provider is considered an employee).

Allowable Expenses for Non-payroll Uses of PPP Funds. Four additional categories of eligible expenses for fixed costs were added through legislation enacted in December.

- Covered Operations Expenditures. Costs related to business software or cloud computing services that support business operations, billing, accounting, or record-keeping. For example, for child care programs, this means the cost of child care management system software that supports business operations or other business support.

- Covered Property Damage. Property damage due to public disturbances that occurred during 2020 that are not covered by insurance.

- Covered Supplier Costs. Expenses pursuant to a contract, order, or purchase order with respect to perishable goods and other items. For example, for child care programs, this means the purchase of food served to children.

- Covered Worker Protection Equipment. Expenses that support business activities to comply with COVID requirements established by the U.S. Department of Health and Human Services, Centers for Disease Control, Occupational Safety and Health Administration, or any equivalent requirements or guidance by a state or local government during the pandemic. For example, for child care programs, this means expenses for PPE, cleaning supplies, sneeze guards, portable water stations, and other expenses related to social distancing and public health requirements related to COVID.

Note: Although expenses related to fixed costs were expanded in legislation enacted by Congress in December, the requirement for at least 60% of PPP loans to be used for payroll related purposes remains in place. Payroll expenses include cash compensation, employer contributions for group health, life, disability, vision or dental insurance and employer contributions to employee retirement plans (exception: benefits for the self-employed (e.g., family child care providers) are not included because the SBA considers such payments already included in compensation).

Each of the SBA Forms that correspond to PPP loans is accompanied by detailed instructions: 4 pages of instructions to explain SBA Form 3508S, 5 pages of instructions to explain SBA Form 3508EZ, and 8 pages of instructions to explain SBA Form 3508.

For help in completing SBA forms, ask your lender or reach out to your local Small Business Development Center (SBDC) or, call the SBA Hotline: 877-552-2692 for help with the portal.

- How to Apply for the Economic Injury Disaster Loan (EIDL) Program (February 4, 2021)

- Top Three Record Keeping Tips for 2021

- How the New Tax Law Affects Family Child Care Providers

- 2021 Standard Mileage Rate Announced

- The Truth About Parent Receipts

- How Can Sponsors and Providers Rebuild in the Midst of a Pandemic (Child and Adult Care Food Program, CACFP)

Tools You Can Use to Support

Your Registered Family Child Care Home!

Have your heard about our online family child care toolkit? Learning resources, business templates, discounts on frequently purchased products and more!

- Recorded Webinar. Overview of the Online Family Child Care Toolkit (January 23, 2021)

- Slides (Introduction to the webinar)

For more information contact:

Monmouth County

Courtney Noll

cnoll@ccrnj.org

732-918-9901 ext. 132

Camden County

Mary Ferro

mary.ferro@camdencounty.com

856-374-5122

Contacta con nosotras en español

Monmouth County

Monica Orozco

Morozco@ccrnj.org

(732) 918-9901 Ext. 104

Camden County

Fior Fernandez

fior.fernandez@camdencounty.com

(856) 401-6442

COVID-19 Child Care Information – NJ Child Care Agencies

Overview Resources:

Child Care Aware of New Jersey:

Small Business Administration:

- SBA Online Portal for Loan Forgiveness (at or below $150,000)

- Online Portal Help Guide (FAQ slides)

- Lender List – Banks that have opted into the SBA online portal

- SBA Form 3508S. This form is for borrowers of $150,000 or less. It’s a short one page form. (Your lender may use this form or one that is equivalent)

- SBA EIDL Loan Overview (U.S. Small Business Administration, January 2021)

- SBA Targeted EIDL Advance Overview (U.S. Small Business Administration, January 2021)

- FAQs from Tom Copeland’s web site related to SBA relief (e.g., First and Second Draw PPP loans for family child care providers)

Unemployment:

- Unemployment Compensation Update (One Pager, Committee for Economic Development, March 2021)

Internal Revenue Service:

- IRS Employee Retention Tax Credit Overview (Child Care Aware of New Jersey, March 2021)

COVID-19 Economic Injury Disaster Loans. The U.S. Small Business Administration offers low interest loans to small businesses, including family child care providers. Unlike the PPP program, the Economic Injury Disaster Loans (referred to as EIDL) are not forgivable. The interest rate for family child care homes is 3.7%. Payments are deferred for one year (although interest accrues). The loan is for 30 years, but can be paid back sooner if the borrower chooses to do so.

Targeted EIDL Advance funds of up to $10,000 (which are grants, not loans) will be available to applicants located in low-income communities who previously received an EIDL Advance for less than $10,000, or those who applied but received no funds due to lack of available program funding. Applicants may qualify if they:

- Are located in a low-income community. The definition of a “low-income community” is defined here.

- Have more than a 30% reduction in revenue during an 8-week period beginning on March 2, 2020, or later. Providers will be asked to provide gross monthly revenue (all forms of combined monthly earnings received) to confirm the 30% reduction.

Applicants do not need to take any action at this time. The SBA will reach out to those who qualify.

U.S. Internal Revenue Service (IRS) Business Relief Options for Family Child Care Homes

Employee Retention Tax Credit. For family child care providers that have an employee, you may also qualify for an employee retention tax credit. Read this one pager on the Employee Retention Tax Credit and talk to your tax preparer to see if you can claim this tax credit.

- New Jersey Economic Development Authority Home Page (the resources below can all be found on the NJ EDA website! Check it out!)

- Business.NJ.Gov, New Jersey COVID-19 Business Information (COVID rules & guidance plus grants & loans)

- What county and local government financial assistance programs are available for my business?

- Where can I find more information about the NJ Small and Micro Business PPE Access Program?

Professionalize Your Family Child Care Home

- Recorded Webinar with Q&A. How to Effectively Use Contracts & Policies for Family Child Care Homes in the Age of COVID-19 by Tom Copeland, February 22, 2021

- Slide Presentation from the February 22, 2021 Recorded Webinar

Money Management & Retirement Planning

• Recorded Webinar with Q&A. Money Management and Retirement Planning by Tom Copeland, March 1, 2021

• Slide Presentation from the March 1, 2021 Recorded Webinar

• Individual Retirement Account (IRA) Comparison Matrix (One page explainer, March 2, 2021)

Tuesday Tips: Newsletters

Business Tips

2022 NJ Stabilization Grants:

- NJ Child Care Stabilization Grant and Retention Bonus (April 19, 2022) English and Spanish

- NJ Child Care Stabilization Grant (March 1, 2022) English and Spanish

Business Tips:

- Getting Ready to File Your Taxes (January 30, 2024) English and Spanish

- The Child and Adult Care Food Program (CACFP) Federal Reimbursement for Nutritious Meals and Snacks (June 13, 2023) English and Spanish

- Tax Prep Online FCC Toolkit Resources & Tax Webinar Follow-up (March 28, 2023) English and Spanish

- Organizing Your Expense Information to File Your Taxes (February 21, 2023) English and Spanish

- Preparing for Filing Your Taxes (January 17, 2023) English and Spanish

- Marketing Ideas for Family Child Care (June 21, 2022) English and Spanish

- Curriculum and Business Tips (May 17, 2022) English and Spanish

- FCC Online Toolkit (March 29, 2022) English and Spanish

- Creating an Employer Identification Number (March 23, 2021) English and Spanish

- Creating a Business Bank Account (March 30, 2021) English and Spanish

- PNC Bank Flyer

- Santander Business Banking Flyer

- Tax Tips and Filing Deadline Extension to May 17, 2021 (April 6, 2021) English and Spanish

- Registering Your Child Care Program with a “Doing Business As” or DBA name. (April 13, 2021) English and Spanish

- Family Child Care Homes and Zoning (April 20, 2021) English and Spanish

- Recordkeeping and Family Child Care Homes (April 27, 2021) English and Spanish

- Easy Marketing Tips for your FCC Business (May 25, 2021) English and Spanish

- COVID-19 Expense Tracker Template

- The Basics of Using Excel Spreadsheets – Simple Steps for Mastery in Minutes (May 4, 2021) English and Spanish

- Using the MyKidzDay App to Organize Your Records and Communicate with Parents (May 11, 2021) English and Spanish

- American Rescue Plan: Affordable Health Care Coverage through Get Covered New Jersey (English and Spanish)

- Overview Resources for family child care providers (June 15, 2021) English and Spanish

- Mask Use in Family Child Care Homes (July 13, 2021) English and Spanish

- Camden and Monmouth FCC Business Web Page Resource (July 20, 2021) English and Spanish

- MyKidzDay App Helps You Organize Your Business and Communicate with Parents (August 3, 2021) English and Spanish

- The Child and Adult Care Food Program (CACFP) also called “the food program” reimbursement for healthy meals and snacks (August 10, 2021) English and Spanish

- MyKidzDay Reminder – The app that supports your business! (August 31, 2021) English and Spanish

- Business Resources for You! (September 7, 2021) English and Spanish

- Using Contracts for Your Business! (September 14, 2021) English and Spanish

- Tom Copeland Upcoming Business Webinars: Maximize Your Income! (September 21, 2021) English and Spanish

Provider Wellness/Health Care

- FCC Alliance Telemedicine and Teletherapy (November 22, 2022) English and Spanish

- The American Rescue Plan made health care coverage more affordable! The Inflation Reduction Act extended health care subsidies through 2025.

- American Rescue Plan Health Insurance One Pager (August 29, 2022) Check out GetCoveredNJ today!

- Colds, Flu, RSV, and COVID Tips for Providers and Families (December 20, 2022) English and Spanish

Child Care Aware of New Jersey:

- COVID-19: Child Care & Recordkeeping 1 pager (May 1, 2021)

Child Development

Supporting Children in Transitions (September 19, 2023) English and Spanish

Strengthening Children’s Fine and Gross Motor Skills – Resources for FCC providers and Parents

- Ages & Stages Learning Activities

- Fine Motor Skill Building Activities for the Home

- Gross Motor Practice Skills and Activities

- Parent Activity Guide for Birth to 3

- Child Activities to Strengthen Fine and Gross Motor Skills (June 1, 2021) English and Spanish

- Summer Professional Development Trainings for family child care providers (June 8, 2021) English and Spanish

- Summer Fun Activities for Children in Family Child Care Homes (June 22, 2021) English and Spanish

- Summer Fun Learning Activities (July 6, 2021) English and Spanish

- Child Development Activities Following August 11 FCC Alliance Child Development Meeting (August 17, 2021) English and Spanish

- Camden and Monmouth County FCC Alliance Meeting, Early Childhood Development (Recorded Video, August 11, 2021)

- Social and Emotional Formation Initiative (SEFI) Panel Presentation Resources (October 2021) English and Spanish

- Social and Emotional Formation Institute (SEFI)

- SEFI Flyer

- Exploring Feelings Reading List (Books for Young Children provided by Montclair State University)

- 13 Children’s Books for Social and Emotional Learning (Teachstone, 2021)

Computer Trainings!

Holiday Tips & Activities

- Recorded Camden & Monmouth FCC Alliance Meeting, MKD Introduction (July 29, 2021)

- Camden and Monmouth County FCC Alliance Meeting, Early Childhood Development (Recorded Video, August 11, 2021)

- Camden and Monmouth County FCC Alliance Webinar, Tom Copeland – Maximizing Income: Recordkeeping to Support All Possible Tax Deductions(Tom Copeland, October 6, 2021)

- Recorded Video

- Camden and Monmouth County FCC Alliance Webinar, Tom Copeland – Maximizing Income: The Child and Adult Care Food Program and Tracking Meals Not Reimbursed by the Food Program(Tom Copeland, October 13, 2021)

- Recorded Video

- Slide Presentation

- Camden and Monmouth County FCC Alliance Webinar, Tom Copeland – Maximizing Income: Recording All the Hours Providers Work to Maximize Tax Deductions (Tom Copeland, October 20, 2021)

- Recorded Video

- Slide Presentation

- Additional Resources:

- Time-Space Percentage Brief Explainer (1 pager, English & Spanish)

- Tom Copeland article on calculating the time-space percentage

- Excel Template to calculate your time-space percentage

- Tracking All Your Hours Downloadable Excel Template (version 1)

- Tracking All Your Hours Downloadable Template (version 2 from the online FCC toolkit)

Note: 2 versions are presented, use what works for you best – or modify and create your own!