FCC Alliance Business Support

Tax Tips for Registered Family Child Care

Don’t Let Tax Time Get You Down! We have resources to help!

2024 Taxes (for filing in the Spring of 2025)!

On February 26, 2025, Child Care Aware of New Jersey held a tax preparation webinar going over basic concepts, business expenses, shared expenses, IRS forms, and worksheets and templates to help FCC providers. If you missed the session, you can watch the recorded video here. The slide presentation is also available in English and Spanish.

Tax Concept One Pagers – Simple Explainers (See Below Documents)

- The Time-Space Percentage Explainer (one pager). The time-space percentage is important because this is the percentage that is applied to shared expenses (i.e., expenses that are partially business related and partially personal) when adding deductible expenses to your tax forms. English & Spanish

- IRS Form 8829 Explainer (one pager). This is the IRS form where you list shared expenses. The time-space percentage is used for the calculation on this form. English & Spanish

- IRS Schedule C Explainer (one pager). This is the IRS form where you list all your expenses that are 100% related to operating your business. English & Spanish

Worksheets & Tools to Make Filing Taxes (and record-keeping) Easier!.

- IRS Schedule C Expense Worksheet (Explained Expense List adjacent to IRS Schedule C Form, February 2025) English & Spanish

- IRS Form 8829 Shared Expense Worksheet (Explained Shared Expenses List adjacent to IRS Form 8829 Form, February 2025) English & Spanish

- Time-Space Worksheet (Excel tool to calculate time-space percentage, February 2025) English & Spanish

- Time Tracker (Use this worksheet to track your working time every day/every week to prepare for the time-space percentage used in IRS Form 8829 — not just the time you spend caring for children but all the other things you do to support your business) English & Spanish

- Monthly Attendance and Payment Log. (Excel, use this template to track child payments & Monthly Meals & Snacks). English & Spanish

- Monthly Business Expense Log (Excel, use this template to track business expenses to support your FCC program) English & Spanish

NJ Shared Resources Online Family Child Care Toolkit

Health Insurance Resources

The American Rescue Plan made health care coverage more affordable! The Inflation Reduction Act extended health care subsidies through 2025.

- American Rescue Plan Health Insurance One Pager (August 29, 2022)

Professionalize Your Family Child Care Home

- Recorded Webinar with Q&A. How to Effectively Use Contracts & Policies for Family Child Care Homes in the Age of COVID-19 by Tom Copeland, February 22, 2021

- Tom Copeland slide deck from the February 22, 2021 Recorded Webinar

Key Child Care State Agencies

Department of Human Services, Division of Family Development

Department of Children and Families, Office of Licensing

Check out the business resources in the NJ Shared Resources Platform online family child care toolkit!

- Discounts on frequently purchased products

- Financial management and templates

- Record-keeping forms and parent contracts

- Forms and policies

- Creating a profit & loss statement

- And more!

Contact your local Child Care Resource and Referral (CCR&R) agency if you need help gaining access to the NJ Shared Resources Platform. CCR&R staff can also help identify resources in the toolkit to help with your day to day work. Download this cheat sheet of resources contained in the platform.

Marketing Resources

The NJ Shared Resources Platform has a wide array of marketing resources – including a list of 25 no cost (or low cost) ways to market your program!

- Email marketing for Beginners (Video)

- Google Ads for Beginners (Video)

Basic Business Resources

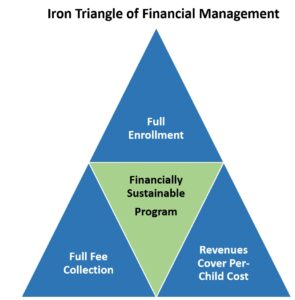

- FCC Financial Management Toolkit (Opportunities Exchange)

- FCC Financial Management Self-Assessment (Opportunities Exchange)

- FCC Budget Template | Provider (Excel Download, Opportunities Exchange)

- Child Care Management System Software (Software to help you run your business).

- Frequently Asked Questions (Opportunities Exchange)

- Child Care Business Tax Resources (Civitas Strategies)

Federal Help for Child Care Businesses

- Small Business Administration (SBA): Support America’s small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow their businesses.

- Women Owned Business Center: Find your local Women Owned Business Center for support for women business owners.

- Score: The nation’s largest network of volunteer, expert business mentors. They have helped more than 11 million small business owners since 1964

Access to Capital – Loans

Emergency Planning

Federal and state laws require all regulated child care businesses to have an emergency plan.

There are many templates. Contact your local Child Care Resource & Referral (CCR&R) agency today for help in drafting your plan!

Thriving by Three

The Thriving by Three Infant and Toddler Child Care family child care home grant will help support the development and creation of infant and toddler slots and provide technical assistance to providers for the expansion of child care spaces.

Eligibility Summary

Eligible Providers must:

- Comply with state and federal health and safety requirements for registered family child care providers,

- Comply with the current family child care registration standards for infant and toddler child care, including, but not limited to, child-to-staff ratios and health and safety standards,

- Be in good standing (no enforcement action and/or funding misrepresentation investigation or misuse of funds),

- Use the funds to develop or expand quality child care spaces for infant and toddlers, and

- Participate or apply to participate in the state’s child care quality rating and improvement system, Grow NJ Kids, no later than 12 months after initial grant approval.

Learn more here!

How-To Documents

Submitting an Application Video

Webinar Recording English | en español

Overview PDF English | en español

NJEDA Child Care Facilities Improvement Program

In 2023, NJEDA accepted applications from child care centers for facility improvement. The agency is now offering a similar program to registered family child care homes. See the NJ EDA Phase 2 FCC Facilities Improvement Program web page. Phase 2 is a pilot grant of $5 million to support New Jersey Registered Family Child Care homes (FCCs) with the purchase of furniture, fixtures, and equipment (FFE) that will contribute to Health, Safety and Accessibility and/or High Quality Learning Environments. Grants between $10,000 and $20,000 are available pending approval of an application.

Webinars:

- Program Overview Webinar Presentation – English

- Child Care Phase 2 (English recording)

- Información general: Grabación en español

FAQS:

Tuesday Tips: Newsletters

Business Tips

2022 NJ Stabilization Grants:

- NJ Child Care Stabilization Grant and Retention Bonus (April 19, 2022) English and Spanish

- NJ Child Care Stabilization Grant (March 1, 2022) English and Spanish

Business Tips:

- Getting Ready to File Your Taxes (January 30, 2024) English and Spanish

- The Child and Adult Care Food Program (CACFP) Federal Reimbursement for Nutritious Meals and Snacks (June 13, 2023) English and Spanish

- Tax Prep Online FCC Toolkit Resources & Tax Webinar Follow-up (March 28, 2023) English and Spanish

- Organizing Your Expense Information to File Your Taxes (February 21, 2023) English and Spanish

- Preparing for Filing Your Taxes (January 17, 2023) English and Spanish

- Marketing Ideas for Family Child Care (June 21, 2022) English and Spanish

- Curriculum and Business Tips (May 17, 2022) English and Spanish

- FCC Online Toolkit (March 29, 2022) English and Spanish

- Creating an Employer Identification Number (March 23, 2021) English and Spanish

- Creating a Business Bank Account (March 30, 2021) English and Spanish

- PNC Bank Flyer

- Santander Business Banking Flyer

- Tax Tips and Filing Deadline Extension to May 17, 2021 (April 6, 2021) English and Spanish

- Registering Your Child Care Program with a “Doing Business As” or DBA name. (April 13, 2021) English and Spanish

- Family Child Care Homes and Zoning (April 20, 2021) English and Spanish

- Recordkeeping and Family Child Care Homes (April 27, 2021) English and Spanish

- Easy Marketing Tips for your FCC Business (May 25, 2021) English and Spanish

- COVID-19 Expense Tracker Template

- The Basics of Using Excel Spreadsheets – Simple Steps for Mastery in Minutes (May 4, 2021) English and Spanish

- Using the MyKidzDay App to Organize Your Records and Communicate with Parents (May 11, 2021) English and Spanish

- American Rescue Plan: Affordable Health Care Coverage through Get Covered New Jersey (English and Spanish)

- Overview Resources for family child care providers (June 15, 2021) English and Spanish

- Mask Use in Family Child Care Homes (July 13, 2021) English and Spanish

- Camden and Monmouth FCC Business Web Page Resource (July 20, 2021) English and Spanish

- MyKidzDay App Helps You Organize Your Business and Communicate with Parents (August 3, 2021) English and Spanish

- The Child and Adult Care Food Program (CACFP) also called “the food program” reimbursement for healthy meals and snacks (August 10, 2021) English and Spanish

- MyKidzDay Reminder – The app that supports your business! (August 31, 2021) English and Spanish

- Business Resources for You! (September 7, 2021) English and Spanish

- Using Contracts for Your Business! (September 14, 2021) English and Spanish

- Tom Copeland Upcoming Business Webinars: Maximize Your Income! (September 21, 2021) English and Spanish

Supporting Children in Transitions (September 19, 2023) English and Spanish

Strengthening Children’s Fine and Gross Motor Skills – Resources for FCC providers and Parents

- Ages & Stages Learning Activities

- Fine Motor Skill Building Activities for the Home

- Gross Motor Practice Skills and Activities

- Parent Activity Guide for Birth to 3

- Child Activities to Strengthen Fine and Gross Motor Skills (June 1, 2021) English and Spanish

- Summer Professional Development Trainings for family child care providers (June 8, 2021) English and Spanish

- Summer Fun Activities for Children in Family Child Care Homes (June 22, 2021) English and Spanish

- Summer Fun Learning Activities (July 6, 2021) English and Spanish

- Child Development Activities Following August 11 FCC Alliance Child Development Meeting (August 17, 2021) English and Spanish

- Camden and Monmouth County FCC Alliance Meeting, Early Childhood Development (Recorded Video, August 11, 2021)

Provider Wellness/Health Care

- FCC Alliance Telemedicine and Teletherapy (November 22, 2022) English and Spanish

- The American Rescue Plan made health care coverage more affordable! The Inflation Reduction Act extended health care subsidies through 2025.

- American Rescue Plan Health Insurance One Pager (August 29, 2022) Check out GetCoveredNJ today!

- Colds, Flu, RSV, and COVID Tips for Providers and Families (December 20, 2022) English and Spanish

Child Care Aware of New Jersey:

- COVID-19: Child Care & Recordkeeping 1 pager (May 1, 2021)

Child Development

- Social and Emotional Formation Initiative (SEFI) Panel Presentation Resources (October 2021) English and Spanish

- Social and Emotional Formation Institute (SEFI)

- SEFI Flyer

- Exploring Feelings Reading List (Books for Young Children provided by Montclair State University)

- 13 Children’s Books for Social and Emotional Learning (Teachstone, 2021)

Computer Trainings!

Holiday Tips & Activities

Links to Internal Revenue Service (IRS) Forms & Material

- IRS Form Schedule C – Profit or Loss from Business (Sole Proprietorship)

- IRS Video – Schedule C: Who need to file this form and how to do it

- IRS Publication, Schedule C Instructions & Additional Information

- IRS Form 8829 – Expenses for Business Use of Your Home

- IRS Publication, Form 8829 Instructions & Additional Information

- All IRS Forms and Publications

Health Insurance Resources

The American Rescue Plan makes health care coverage more affordable! If you do not currently have health insurance or, have health insurance through Get Covered New Jersey, you may be able to get free or greatly reduced cost health coverage. Read our one pager to learn more!

- American Rescue Plan Health Insurance One Pager (August 29, 2022)

Professionalize Your Family Child Care Home

- Recorded Webinar with Q&A. How to Effectively Use Contracts & Policies for Family Child Care Homes in the Age of COVID-19 by Tom Copeland, February 22, 2021

- Tom Copeland slide deck from the February 22, 2021 Recorded Webinar

Other Resources from Tom Copeland

- Tom Copeland’s web site (Tom has retired. Civitas Strategies is carrying on his work)

- How to Find, Choose and Work with a Tax Professional (January 16, 2021)

- How to Apply for the Economic Injury Disaster Loan (EIDL) Program (February 4, 2021)

- Top Three Record Keeping Tips

- How the New Tax Law Affects Family Child Care Providers

- 2023 Standard Mileage Rate Allowed

- The Truth About Parent Receipts

- What Are the Tax Consequences of a State Grant? (February 8, 2021)

- Recorded Webinar with Q&A. Money Management and Retirement Planning by Tom Copeland, March 1, 2021

- Slide Presentation from the March 1, 2021 Recorded Webinar

- Individual Retirement Account (IRA) Comparison Matrix (One page explainer, March 2, 2021)

Additional Videos for Family Child Care Providers

- The Best Business Structure for a Family Child Care Provider (Tom Copeland)

- Three Record Keeping Tips for Family Child Care Providers (Tom Copeland)

- The Two Most Important Terms to Include in a Contract (Tom Copeland)

- How Do Providers Pay Themselves? (Tom Copeland)

- How to Find and Choose a Tax Preparer (Tom Copeland)

- Is Your Home, Business and Vehicle Properly Insured? (Tom Copeland)

Tools You Can Use to Support Your Registered Family Child Care Home!

Have your heard about the online family child care toolkit? Learning resources, business templates, discounts on frequently purchased products and more!

Recorded Webinar. Overview of the Online Family Child Care Toolkit (January 23, 2021)

Slides (Introduction to the webinar)

For more information contact your local CCR&R!

Overview Resources

Child Care Aware of New Jersey:

Child Care & Recordkeeping (One Pager, May 1, 2021)

Expense Tracker Template

For more information contact:

Monmouth County Courtney Noll

cnoll@ccrnj.org

732-918-9901 ext.132

Veronica Soto

vsoto@ccrnj.org

732-918-9901 Ext.103

Camden County

Mary Ferro

mary.ferro@camdencounty.com

856-374-5122